People frequently invest in apartment buildings not because they make huge profits fast, but because they are built to be safer and more predictable. Not like owning a single property—where one tenant or one problem can cause great issues—apartments have various units and tenants, which spreads the threat and makes things more stable. Owning apartments is less about hoping the property’s value goes up or that each unit is rented each time, and more about following steady systems, routines, and careful management.

Risk Distribution Across Multiple Units

Apartment buildings spread risk across multiple units rather than relying on a single unit. Each unit takes in a small share of the total income, so complications in one unit do not affect the building as a whole. In a single-unit property, if the tenant leaves, all income stops. This stability is why many investors look to buy flats and apartments in Lahore, as other tenants continue to pay rent, ensuring the building usually continues to run.

Because of this, small problems are easier to manage. Late rent, tenant move-outs, or non-renewals do not cause a crisis. The effect is shared across the building, which has steadier income and more predictable ownership.

Key Points:

Vacancy Smoothing: One empty unit does not end all income

Revenue Stability: Rent carried over from other units

Lower Dependence: The property does not rely on one tenant

Spreading risk across various units makes the investment stronger and stress-free to handle over time.

Predictable Demand and Occupancy Behavior

Apartments have a steady demand as people always want a place to live. Housing is a basic want, not a luxury. Even if people change their location or lifestyle then they still wish for housing. Apartments attract a variety of residents because they are affordable, flexible and close to work and everyday services. This is why demand typically adjusts to economic changes rather than discontinuing.

When the market changes, some tenants move to smaller units, some delay purchasing homes and new renters enter the market. Even if a few units become vacant then building as a whole typically stays occupied. These changes occur gradually, giving owners time to manage them without pressure.

Key Points:

Steady Need: People need housing constantly.

Changing Tenants: Residents may change but demand stays.

Slow Changes: Occupancy shifts happen over time.

Easy Management: Owners can make changes through regular operations.

As demand is predictable, apartment buildings remain stable even throughout changing market conditions.

Operational Scale and Management Efficiency

As a property increases in value, managing it becomes easier in different ways. In apartment buildings, tasks such as repairs, leasing and paperwork are handled collectively rather than individually for each unit. Repairs follow fixed instructions, renting follows the same steps and choices are made using past involvement, not guesswork. This makes day-to-day work smoother and more predictable. Management becomes routine, not rushed. Ownership feels more organized and less worrying.

Key Points:

One System: Care and leasing are handled together

Simple Processes: The same steps are followed each time

Professional Management: The property is run like a business

Less Owner Stress: Fewer everyday problems, more centered on planning

Scale makes property ownership simpler, calmer, and less stressful to manage over time.

Cash Flow Stability Over Time

Apartment buildings may earn more in some months and less in others, but over time, income remains steady. Each apartment has a different lease period, so rent does not end at the same time. If one tenant leaves, other tenants are still paying rent, and new ones may move in. This has income coming in habitually. Costs are shared across various units, so a single repair or an empty unit does not cause significant concern. Owners look at full income over time instead of being upset about one bad month. This makes planning easier and ownership less worrying.

Key Points:

Different Lease Dates: Rent carries on even if one tenant leaves

Steady Income: Monthly ups and downs balance out

Shared Costs: One expense disturbs the building less

Less Stress: Less concerns about short-term changes

Steady cash flow makes it easier to plan and invest with peace of mind.

Pricing Power and Incremental Growth

Apartment owners have small benefits in making money steadily. Rent typically goes up a little at a time, for each unit distinctly. Hence, tenants are not surprised, and occupancy stays stable. Each apartment can be priced to achieve the best rent, based on size, condition, and demand. Growth happens gradually and naturally: when leases end, owners can make improvements and adjust rents without hurting overall income. These small changes over time add up, resulting in a steady, consistent increase in revenue. Owners can plan carefully rather than react to unexpected market changes.

Key Points:

Small Rent Increases: Increase rent gradually for each unit.

Manage Each Apartment: Make each unit earn its best rent.

Steady Growth: Income grows gradually over time.

Easy Planning: Changes are easy and uncomplicated.

Little steps over time make durable, long-term earnings.

Long-Term Portfolio Fit

Apartment buildings are a good option for investors who think long-term. They are easy to manage with systems in place, and ownership can be easily transferred. Running them doesn’t depend on one person doing all. For long-term planning, apartments fit well into a greater investment approach. They run predictably and reduce owners' everyday stress. These investments are not for everybody. They want patience, steady effort, and trust in the system rather than hoping for fast wins.

Investors who like fast-changing or hands-on projects may miss out on apartments. But for those who want stability, they are a reliable option.

Key Points:

Good for Long-Term Goals: Apartments suit investors planning for the long term. Income and management are steady over time. They are less affected by temporary market changes, allowing owners to focus on long-term growth. These investments reward patience and cautious planning.

Predictable Operations: Apartments run on clear systems. Care, leasing, and tenant management follow set routines. Owners can trust managers or procedures to reduce stress and avoid hasty decisions. Predictable operations make it easier to plan cash flow and fit apartments into a larger portfolio.

Steady Returns: Apartments offer reliable, moderate returns. They are not for fast profits or big swings. Growth comes gradually but steadily. Over time, this stable income builds wealth securely and balances riskier investments in a portfolio.

Best for Systematic Investors: Success comes from following systems, using data, and being patient. Those who need fast changes or hands-on excitement may discover apartments less exciting. For disciplined investors, apartment proposals offer a low-stress way to grow wealth over the long term.

Apartment buildings reward patience, good systems, and long-term thinking, making them a smart fit for well-planned investment portfolios.

Final Thoughts

In conclusion, people invest in apartment buildings not to get quick, big profits, but to earn steady returns over time. They share threats across many units, use expert management, and don’t trust one tenant or lease. Apartment financing suits those who like stability, planning, and systems. If you prefer fast gains or continuous hands-on work, other investments may be well-suited. The main point is to know what apartments actually offer. Success comes from aligning your objectives with the steady, predictable nature of apartment ownership, rather than chasing hype or short-term gains.

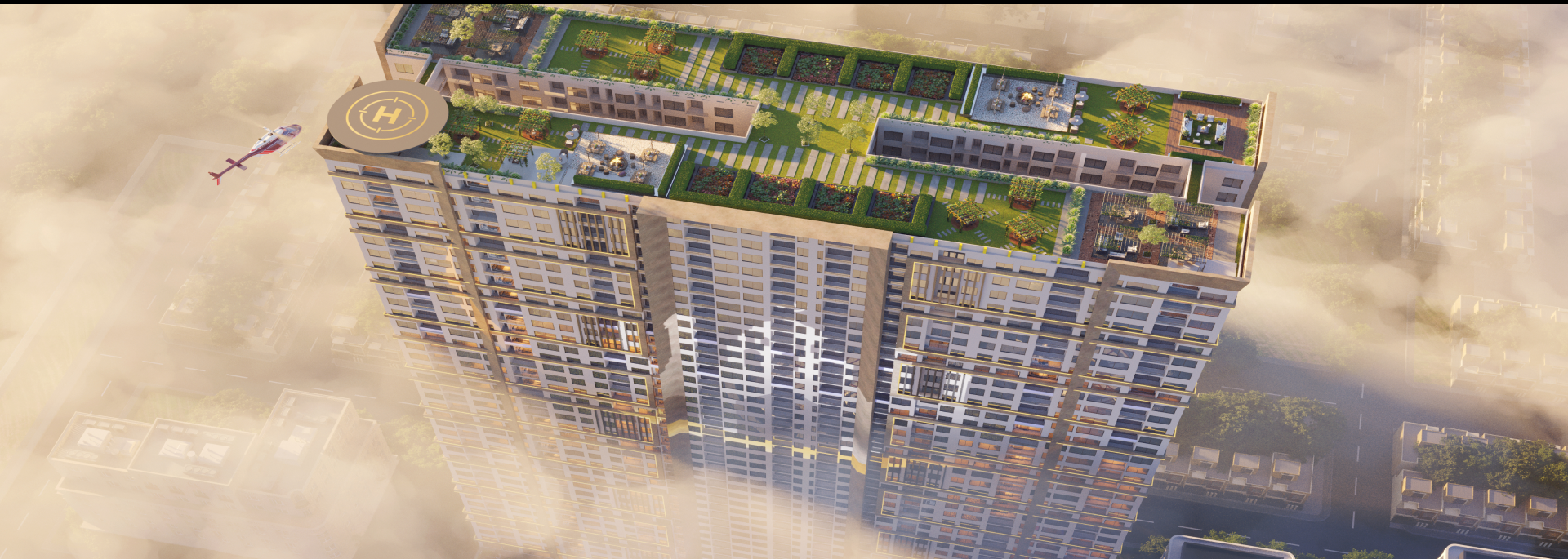

Learn More: Living in a High-Rise Apartment