Purchasing a house is exciting but it can also be difficult. If you need to buy a home in Pakistan in early 2026, now is a good time to get prepared. With more cities developing, supportive government schemes, and new property areas, 2026 is a smart time for home buyers.

This easy guide will show you what to do: plan your budget, choose the right property, check all legal papers, select the correct time, handle risks and get instructions for overseas Pakistanis.

Whether you are purchasing your first home, moving to a larger one or living abroad then this guide will make the procedure stress-free and less worrying.

Why the Pakistani Housing Market in 2026?

Market trends & demand-supply dynamics

More people are moving to cities in Pakistan particularly young families and working professionals which is increasing the demand for houses and apartments.

More people are moving to cities in Pakistan, particularly young families and working professionals, which is increasing the demand for houses and apartments. Big cities like Lahore, Karachi, and Islamabad are seeing a surge in consumers, while smaller towns are also getting new housing societies and gated communities.

If you’re planning to invest, it’s worth exploring LDA-approved societies in Lahore to ensure your property is legally recognized and has long-term growth potential. Knowing how many houses are accessible versus how many people want them can help you choose properties that may increase in value.

Government policies & tax/incentive changes

The Budget 2025-26 has introduced some benefits for people buying property. Taxes like withholding tax and stamp duty have been lowered to make buying easier. The first-time buyers can also get tax breaks if the property is below certain limits.

Paying attention to government rules and incentives can help you save money and avoid to complications. The new infrastructure projects like metro lines and highways are also making some areas more beautiful for buying homes.

Key cities & new hotspots

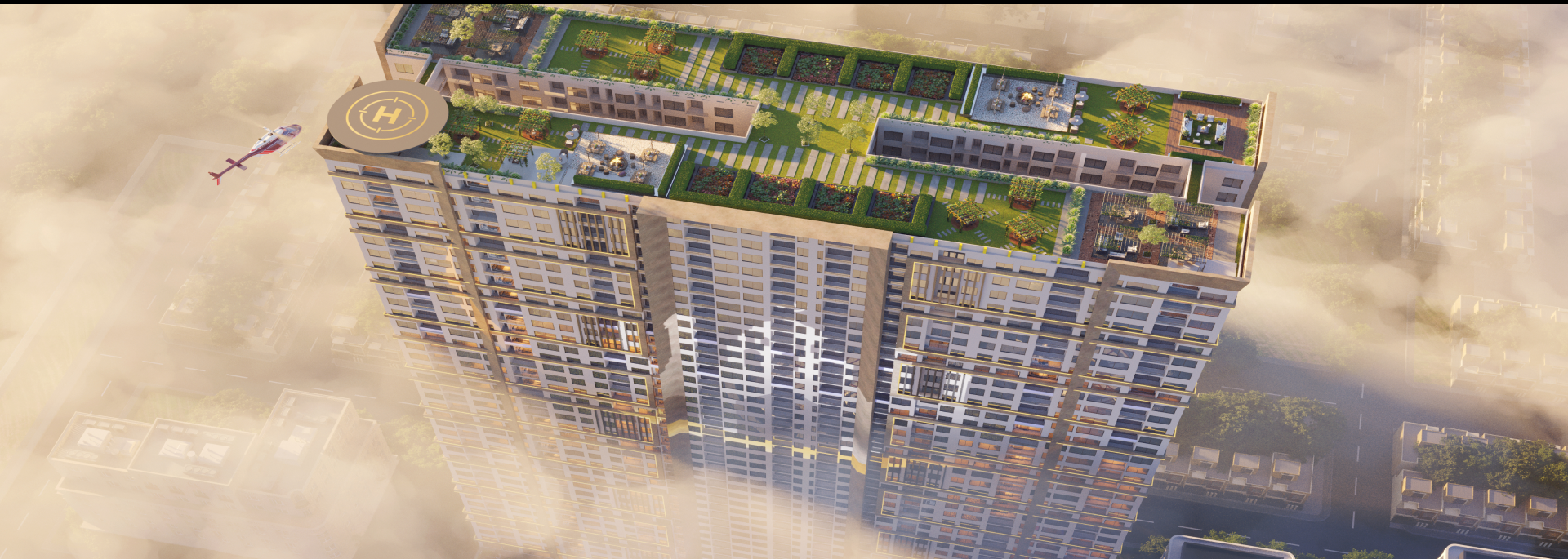

Lahore, Karachi and Islamabad are the most common cities for buying homes. However, cities like Faisalabad, Multan and Peshawar are also becoming more popular. New housing societies in these cities propose modern facilities at good rates. For example, the Kingdom Group is constructing new communities in Lahore and Islamabad which drawing both local and overseas buyers.

Set Your Budget and Explore Financing

When buying a house, recognize how much you can spend. A clear budget saves time, money, and concern. Planning helps you make better selections. How much house can you afford? Look at your income, savings, and monthly bills. Have your home loan EMI under 30-35% of your income. Plan a down payment of 20-30% of the house price.

Financing options in Pakistan: You can use bank loans, builder plans or instalment schemes. Check interest rates, fees, and payment terms. Some developers propose 2-3-year instalments with minor upfront payments, creating a stress-free buying experience.

Hidden and ongoing costs: Don’t overlook more costs like stamp duty, registration, taxes, maintenance, and utilities. Thinking about these timely tips helps avoid surprises and keeps your home worry-free.

If you plan your budget cautiously and include all prices, purchasing your home will be easier, safer, and stress-free.

Picking the Right Location and Property Type

City vs Suburb: Living in the city means you are close to work, schools, hospitals and shops. But house prices are higher. Suburbs have larger homes and silent streets, but travel can take longer. Before deciding where to live, it helps to understand how location affects overall expenses, including per square foot construction cost in Pakistan. Consider what matters more: convenience or space.

Society vs Independent Housing: Gated communities offer security, services and a friendly neighborhood. Independent houses provide more freedom but you have to manage everything yourself. Every time, check the builder’s status, rules, and maintenance price from previous purchases.

House or Apartment: A house offers privacy, more space and room to grow. Apartments are stress-free to look after and frequently have gyms, pools and security. Select based on your lifestyle, family wants and future resale plans.

Legal & Documentation Checklist

Previously buying a house, I would always check the title deed and make sure all approvals were thorough. Make sure the society or project is formally registered and has permission from authorities.

Houses without the right documentation may look low-priced but can cause great legal complications later. Checking these papers wisely keeps your money safe and avoids future clashes.

It is too important to check tax compliance for both the buyer and seller. Equally, there, active taxpayers should be required as unpaid taxes can delay registration or cause problems with ownership.

Research the developer’s status, previous project deliveries and any continuing legal cases. Websites and buyer reviews are supportive. You can also explore insights from trusted property developers in Pakistan to understand which companies maintain a strong market reputation. Avoid developers with constant delays or bad feedback to protect your investment.

Your Purchase & Negotiation Tips

When to buy

The property market changes all over the year. Early 2026 may have lower rates than the busy season, but waiting too long can create homes that are costlier because of increasing costs or new rules. Watch market trends and government incentives. Be patient, but stay prepared to act rapidly when a good deal comes.

Negotiation strategies

Paying in cash can get you discounts while loans or instalments may offer flexible payment options. Each time, check changed developers and properties, and negotiate the rate, payment plan and additions like parking, maintenance or finishing work. Knowing the seller’s situation helps you get a better deal. Take your time and consider an expert or a real estate agent to guide you.

Locking the Deal

When you are pleased with the property, make sure the payment plan and move-in dates are written clearly in the agreement. Check rules about fines, late delivery or construction delays. Check all legal approvals and property papers previously signed.

Be cautious at this stage to protect your money and avoid complications. Each time, have clear written records and communicate openly with the developer.

Living Costs & Resale Considerations

Buying a house or apartment is not only about the price. You will want to allocate funds to maintenance, repairs and sometimes renovations. New homes may have minor problems, while older ones may require more extensive repairs. Planning ahead helps avoid additional prices later.

Things to keep in mind:

Maintenance & Repairs: Set aside money each year for upkeep, apartment fees or fixes.

Resale Value: Good location, close roads, a metro or a reliable developer can make your property worth more in the future.

Exit Plan: Think onward—can you rent or sell the property easily if required?

Knowing these points helps you save money and make better selections for your property.

Risks to Know & How to Mitigate Them

Purchasing property has some threats you should know about. Market risks like inflation, changing currency rates or higher building prices can lower property value. To decrease these threats, don’t put all your money in one place and avoid taking large loans. Legal risks come from missing papers, rule changes or unofficial deals.

Always check the property documents and follow the correct legal steps. Developer risks include late projects, poor quality, or fake schemes. Check the builder’s previous work, visit the site and use reliable agents. Knowing these risks and acting in a timely manner helps mitigate complications and keeps your investment harmless.

Special Tips for Overseas Pakistanis

Buying property from a different country can be exciting but it requires careful planning. Remittance is key—each time send money through legal and official channels to stay harmless and follow the rules.

Keep checking the exchange rate as currency changes can increase your costs. Try to send money when the rate is good or plan transfers cleverly for large payments.

To manage things from abroad, use remote monitoring tools. Employ a reliable local person or property manager to visit the site, take pictures and check documents for you. Virtual tours and video calls can help you get properties without traveling frequently.

Choose your budget, location and property type before starting your search. This makes the procedure faster and simpler and helps you find a home that actually fits your needs.

Your Simple 6-Step Plan (From Start to Moving In)

Find the Right Area: Relate changed cities, towns or societies to select the best location.

Plan Your Budget: Choose how you’ll pay (loan or instalments) and include all prices.

Visit Properties: Check the shortlisted choices in person or through online tours.

Check Documents & Negotiate: Verify all papers, explore the developer and discuss final terms.

Book the Property: Sign agreements and follow the payment plan.

Get Possession & Move In: Complete registration, receive keys and settle into your new home.

Downloadable / Printable Checklist

Use this simple checklist to stay organised when purchasing property:

- Check property papers and approvals.

- Make sure the seller has paid all taxes.

- Look at the developer’s previous work.

- Plan your full budget, with additional costs.

- Visit and inspect the property area.

- Finish all legal papers and NOCs

Final Words

The government is offering support, cities are growing, and new housing areas are opening up, giving purchasers a good chance to invest intelligently. By planning your budget, checking documents, and doing correct research, you can avoid complications and purchase a home that increases in value.

Start discovering locations, associate prices and get your finances in order on time. Don’t wait too long, and acting early helps you get better deals.

Start your home-buying journey now or download the free checklist and get professional help for a smooth buying experience!

Read More: How Does Mutation in Property Work in Pakistan? A Guide