Economic indicators are numbers that display how the economy is doing. Investors watch them not as the numbers are impressive, but as they offer hints about growth, prices, stability, and threats—things that disturb the markets. Not all indicators are similarly important; some really disturb markets, while others don’t tell us much. For investors, the challenge is not finding information, but knowing which numbers to pay attention to and how to understand them clearly.

This context provides little information. Instead, it centers on a few important indicators that actually matter and clarifies what they tell us about the economy. Once you've read, you’ll feel more assured about following the signs that matter.

What Economic Indicators Tell Investors?

"Economic indicators offer investors simple clues about how the economy is doing. They support answering questions like: Is the economy growing or slowing? Are rates going up too fast? Are people earning and spending money? Is it easy or costly to borrow? These indicators don’t expect the future. Instead, they serve as signals to help investors make smart decisions.

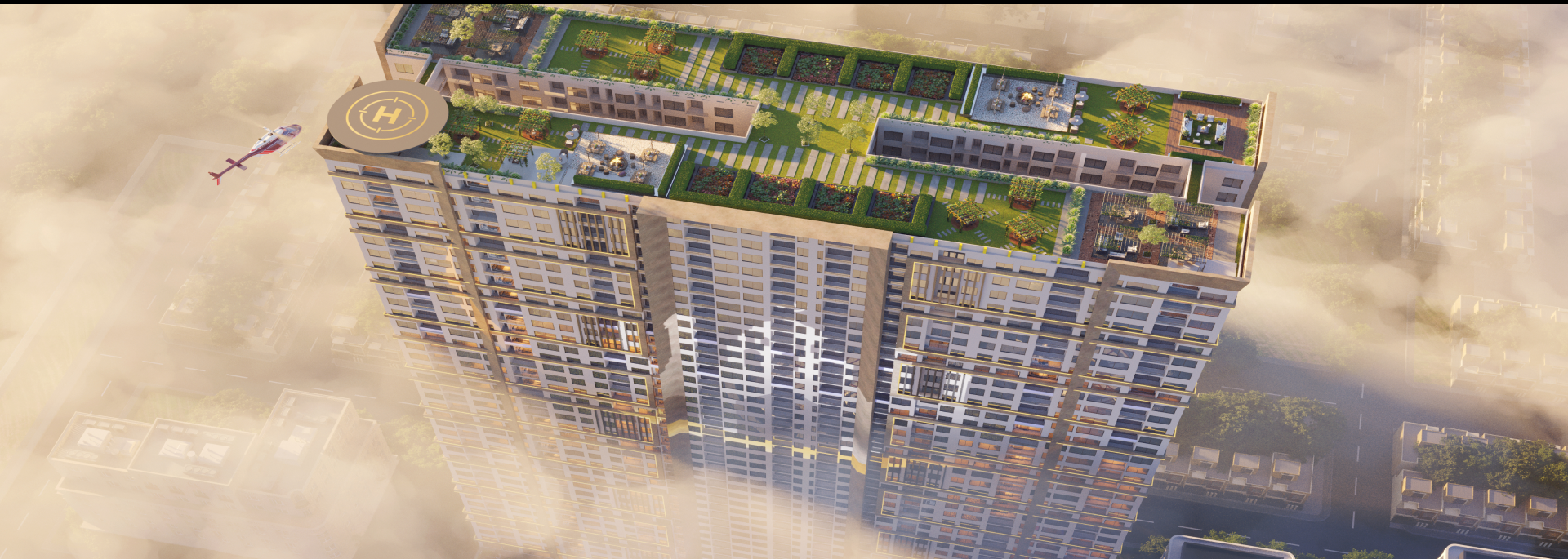

Investors use them to identify trends, risks, and opportunities, not to predict results. For instance, those who monitor these trends often find the right moment to buy flats and apartments in Lahore, using stable economic signals to secure high-value real estate assets."

Economic direction: Indicates whether the economy is getting better or worse.

Growth vs. slowdown: Displays times of fast growth or slow activity.

Inflation pressure: Displays if prices are rising too fast.

Consumer strength: Shows if people are earning and spending well.

Economic indicators offer helpful signals, but they don’t guarantee what will happen.

Growth Indicators Investors Commonly Watch

Investors check growth indicators to determine if the economy is getting stronger or weaker. Even minor changes can disturb how businesses and markets act. It’s worth looking at trends over time rather than just one number, as they show whether companies, people and the economy are doing well or facing challenges.

Key indicators include how much is being made, how much companies are investing and the whole economic output. If these numbers rise, it indicates strong demand and confidence. If they go down, it may mean caution or lower spending. Investors use this to guess future profits, employment and spending.

Examples:

GDP trends – Displays how the economy grows over time.

Industrial production – Displays how much factories and businesses make.

Business investment – Indicates companies' confidence in the future.

Center on what the numbers tell you, not only the formulas.

Inflation Indicators That Influence Markets

Inflation numbers can change markets rapidly. It’s not only that prices go up but also that higher prices affect how much money people can spend and how policies are made. Investors watch to see whether inflation is temporary or will persist. Even minor changes can disrupt stock, bond, and currency markets. When prices rise quickly, daily items cost more, people may spend less, and businesses may raise prices, which can lower profits.

When inflation slows, it typically helps the economy. Markets pay close attention as inflation tells central banks what to do with interest rates. High inflation may lead to greater rates, while low inflation offers more flexibility. That’s why even minor changes in inflation can make markets move.

Key Points:

Inflation Expectations: Displays whether rates will stay high or drop.

Purchasing Power: Higher rates make money worth less.

Central Bank Response: Inflation disturbs interest rate decisions.

Market Reactions: Investors quickly adjust their investments in response to inflation news.

Employment and Labor Market Signals

Jobs and work data display how steady the economy is, not how fast it moves. When many people have jobs, they can earn money, purchase things and keep spending habitually, which supports the economy's growth. If jobs are lost or employment slows then it can be a threatening sign for businesses and investors. Looking at the number of jobs, the kind of jobs being created, wages and employment trends offers a clearer picture of the economy. Investors watch this data closely because it often aligns with other economic indicators such as growth and rates.

Key Points:

Jobs and Hiring: More jobs signal business confidence; fewer jobs can signal that the economy is slowing.

Wages: Small increases in pay support people's spending; rapid pay increases can cause rates to rise.

Investor View: Labor data can display trouble later than other signs so falling jobs can warn of a slowdown.

Watching these signals supports making smart choices.

Interest Rates and Monetary Policy Indicators

Interest rates disturb almost everyone in finance. Investors watch them carefully as rate changes change how people spend and invest. When interest rates are low, borrowing is inexpensive, so businesses and individuals pay more. When interest rates are high, borrowing is more costly, so spending slows. Investors also use rate changes to realize how central banks think the economy is doing. Besides official rates, getting loans matters too. If banks make borrowing harder, it can slow growth even if rates stay the same. Understanding interest rates helps investors assess risk, make investment decisions, and predict market moves.

Interest Rates and Monetary Policy Indicators:

Central bank rates: set the cost of borrowing; affect spending and investment.

Yield curve: Show what the market expects for growth and inflation; changes indicate certainty.

Borrowing conditions: Display how easy it is to obtain loans; difficult borrowing conditions can slow investment and spending.

Center on how investments react to rate changes, not the technical facts.

Consumer and Business Confidence Measures

Consumer and business confidence measures display how people feel about the economy and the future. Not like numbers like GDP or jobs, these measures are about hopes. People who feel safe in their jobs and income tend to spend more, which supports the growth of stores, housing and services. Businesses that feel confident are more likely to employ workers, make more products and invest in new ideas. Surveys ask people about their feelings and plans which offering a glimpse of what might happen next.

Investors and policymakers watch these trends, as changes in confidence can disrupt spending, investment and the broader economy. By showing what people expect, confidence measures add key info that numbers alone can’t provide which helping identify potential risks and opportunities.

How Investors Should Use Economic Indicators

The economic indicators help investors understand what is happening in the economy. Still, they don’t tell you exactly when to buy or sell. Markets frequently move before data is released so making decisions based on a single report can lead to mistakes. It’s better to look at trends over time—to see if things are getting better, worse or staying the same—as a single number typically doesn’t tell the full story.

Investors should use these indicators to guide their plan, not their emotions. Markets can react powerfully to news such as job numbers or inflation even when the broader economy is strong. It helps to center on a few key indicators instead of trying to watch all. This makes it easier to know what actually matters and make smart or steady choices instead of reacting to each headline.

Final Thoughts

To conclude that economic indicators are key not because they tell the future but because they help investors understand how the economy is doing. By watching trends in growth, prices or jobs, interest rates and uncertainty, the investors can spot patterns rather than worry about each news headline.

These indicators offer a clear picture and help make better choices. They don’t accurately predict what will happen but they help investors understand the economy calmly. Concentrating on what the numbers mean makes economic news easier to understand and more useful. Knowing to which indicators matter and how to read them helps investors make smart decisions and feel more confident in the market.

Learn More: Reasons to Invest in Apartment Buildings