This is a very prolonged discussion with no clear answer, as both options have their pros and drawbacks. When deciding between renting or buying an apartment, the right choice depends on your personal preferences, lifestyle, and financial goals. Renting offers flexibility and less responsibility, while buying allows you to build equity and create a permanent home. Each option has its advantages, but understanding the different types of apartments and how they fit your needs can make the decision easier. Whether you're looking for a cozy one-bedroom or a spacious family unit, the choice between renting and buying comes down to your priorities.

In this blog, the ABS Developers will explore the pros and cons of each option, helping you find the best fit for your lifestyle.

Advantages of Buying an Apartment

When you buy your flat for living, here are the common benefits you have:

Building Equity

When you buy an apartment, your monthly payments contribute to building ownership rather than paying rent. Over time, as the value of the property may increase, your equity also grows, which can be a significant financial advantage.

Stability and Security

Owning a flat provides long-term stability. You don't have to worry about rent increases or being asked to move out, which is often a concern for renters.

Customization and Control

As an owner, you have the freedom to make changes to your apartment, whether it's renovating the kitchen or adding personal touches. This level of control is not possible with rented properties.

Investment Potential

Buying an apartment can be a smart investment. If property values rise in your area, your apartment could appreciate, allowing you to sell it for a profit in the future.

Tax Benefits

Homeowners can often take advantage of tax deductions, including mortgage interest and property taxes, which can reduce your overall tax burden.

Long-Term Financial Benefit

While buying an apartment requires an upfront investment, over time, owning a property can be more cost-effective than renting, especially if you plan to stay for several years.

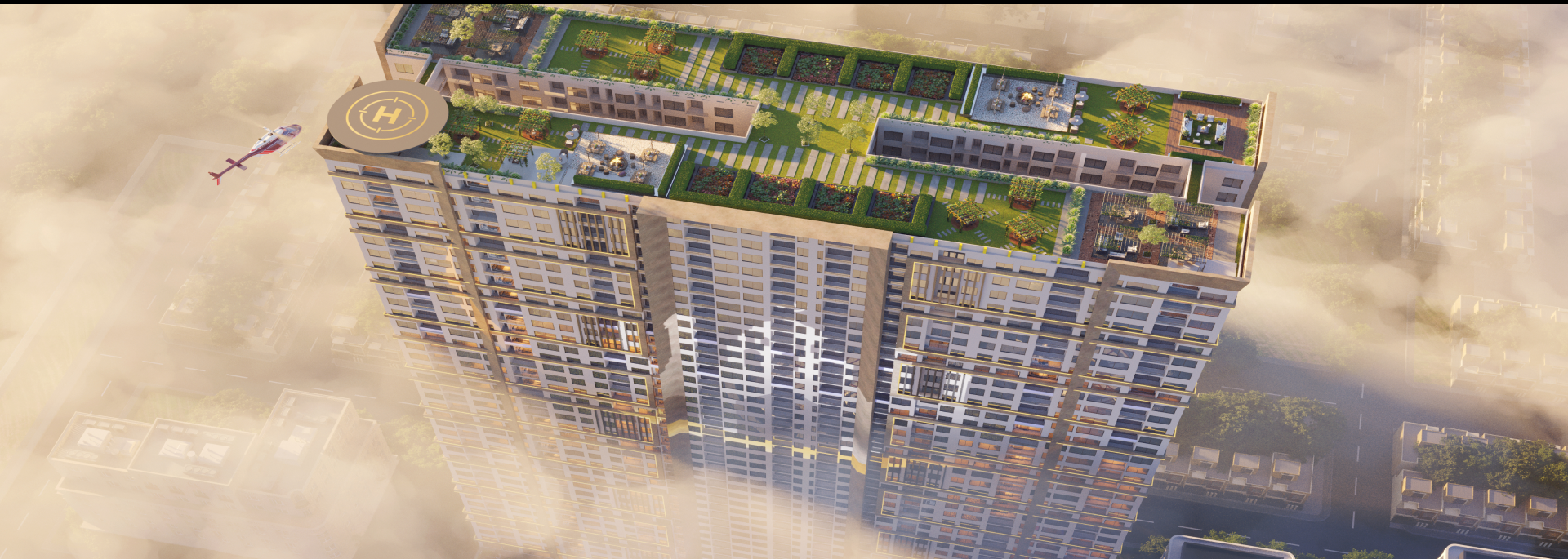

Here are the benefits that we have discussed: why you need to buy an apartment. But this is not the end. The good news is here. ABS Developers has launched its new project named Pearl One Premium in Bahria town, Lahore. This exciting development offers a range of apartments for living, designed with modern amenities and high-quality finishes to provide a luxurious living experience. Located in the heart of Bahria Town. So you can buy an apartment like a house that fits your needs and experience a luxurious lifestyle in Lahore. Pearl One Premium ensures easy access to key areas of the city while offering a peaceful and secure environment for residents.

Advantages of Renting an Apartment

Renting an apartment can be the right choice for those who value flexibility, convenience, and lower financial commitment, especially in the short term. After discussing the pros of buying an apartment, let's take a short look at the pros of renting a flat.

Flexibility and Mobility

Renting an apartment offers flexibility, especially if your job or lifestyle requires frequent relocation. You're not tied down by a long-term commitment, making it easier to move when needed.

Lower Initial Costs

Renting an apartment typically requires less upfront investment than buying one. There are no large down payments or property taxes, making it a more affordable option for those with limited savings.

Maintenance-Free Living

Renters are not responsible for major repairs or maintenance. If something breaks or needs fixing, the landlord takes care of it, saving you time, effort, and money.

Access to Amenities

Many rental apartments come with access to amenities like gyms, pools, or security features, which might be expensive or impractical to install in a home you own.

No Market Risk

Renting means you don't have to worry about fluctuations in property values. If the market takes a downturn, you're not at risk of losing the value of an investment, unlike homeowners.

Lower Monthly Payments

Rent is often more affordable than monthly mortgage payments, allowing you to allocate your budget to other areas such as savings, travel, or leisure activities.

Cost comparison between renting and buying a flat

When deciding whether to rent or buy an apartment, understanding the financial implications of each option is essential. Here's a breakdown of the key cost factors to consider:

1. Initial Costs

For Renting:

- Security Deposit: Typically, a one or two-month rent deposit is required.

- Application Fees: Some landlords charge fees to process your rental application.

- Moving Costs: Renting often involves lower initial costs since there's no down payment or closing fees.

For Buying:

- Down Payment: Generally, buyers need to make a down payment of around 10-20% of the property's purchase price.

- Closing Costs: These can range from 2-5% of the property price and include fees for inspections, appraisals, and legal services.

- Moving Costs: Typically higher than renting due to the need to move into a new property and possibly furnish it.

2. Monthly Payments

For Renting:

- Rent: Monthly rent payments, which can vary depending on the apartment's location, size, and amenities.

- Utilities: Renters may need to pay for utilities (electricity, gas, water, etc.) separately, depending on the rental agreement.

For Buying:

- Mortgage: Monthly mortgage payments, which typically include both the principal and interest on the loan.

- Property Taxes: Homeowners must pay property taxes annually, which can vary depending on the property's value and location.

- Home Insurance: Required for owners to protect their investments.

- Maintenance: Homeowners are responsible for ongoing maintenance costs (repairs, upgrades, etc.), which can add up over time.

3. Long-Term Costs

For Renting:

- Rent payments may increase over time, depending on market conditions, but renters do not have to worry about property value fluctuations or long-term upkeep costs.

For Buying:

- Property values may increase, allowing homeowners to build equity. Over time, the mortgage balance decreases, and after a few years, the property may be worth significantly more than its initial price.

- Maintenance and repair costs are the responsibility of the homeowner, which can add up, especially in older properties.

4. Potential Return on Investment

For Renting:

- Rent payments do not contribute to building equity or ownership. Renters are not able to capitalize on property appreciation.

For Buying:

- Over time, owning an apartment can be a good investment. Homeowners can benefit from potential property value appreciation, and once the mortgage is paid off, they own the property outright.

Conclusion

Renting tends to be more affordable upfront, with lower initial costs and flexibility. However, if you plan to stay long-term, buying an apartment can be a better financial decision in the long run due to the potential for property appreciation, equity-building, and tax benefits. Ultimately, the choice between renting and buying depends on your situation, financial goals, and how long you plan to stay in the property.